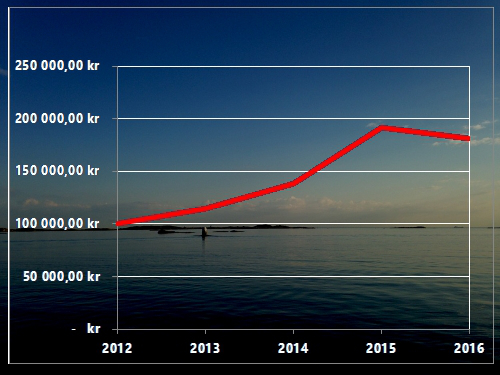

I guess everyone got a little surprised regarding UK and Brexit. Every expert says that today will be a dramatic decrease at the stockmarket. I have some stocks I am looking at and hope actually that these following days they will deacrese in price so that I can buy a couple of stocks on sales. Last few weeks there has been volatility which has given mi opportunity to buy a couple of H&M stocks. Hopefully, this is a good buy and that it will increase with the time. I am still keeping my strategy or idea to try to get a portfolio that is giving me dividends that I can invest again. The interest on interest effect so to say.

Some of the stocks I keep an eye on / Neke od dionica koje pratim

Some of the stocks I keep an eye on / Neke od dionica koje pratim

Mislim da su se svi malo iznenadili sto se tice Velike Britanije i Brexita. Svaki ekspert kaze da ce danas biti prilicno velik pad na berzama u Evropi. Posto imam nekoliko dionica koje pratim onda se stvarno nadam da su ti eksperti u pravu da bih mogla kupiti par dionica na snizenju.

Zadnjih par sedmica su bile dosta volatilne i dale su mi mogucnost da kupim nekoliko H&M dionica. Naravno, nadam se da je to dobra kupovina bila i da ce se vrijednost dionice povisiti i da ce ostati dobra dividenda. Jer jos uvijek je moja strategija ili ideja da probam izgraditi portfolio koji mi daje dividende koje mogu ponovo uloziti u dionice. Tako reci da iskoristim efekat kamate na kamatu.