23.rd of January was the official poorest day of the year. After Christmas and New Year where people have been spending more than they should they have to eat water and “knäckebröd”.

To avoid that I have quite a good check on my/ our economy and also a goal to reach 100 000kr of dividends per year for our retirement.

I could hardly invest any money in 2019 because I needed all the cash we have plus more to finalize one thing and since October I have slooowly started to invest again. It is tricky now because the stocks are pretty expensive and one has to be careful.

I have on a monthly basis been buying a couple of different index funds be it American, European or Swedish. I am also continuing to reinvest dividends that I have obtained during the year. I reached approximately 5500 kr in dividends in year 2019. This is some 15% more than in 2018. I have been between 22-30 % plus on the value of the portfolio…but one has to consider that 2019 was an extremely good year for the stock market.

Anyhow, during this year Swedbank was dragged into a money laundry scandal resulting in a stock price sinking like a stone. I felt, despite the money laundry scandal, that Swedbank is still going stronger than in 2008 during the financial crisis. Also average loan takers are not that flexible to change their mortgage loans so the basic business will continue as usual.

Americans will most probably give Swedbank a juicy fine but in the end the bank should recover from that.

I decided to sell all my H&M stocks on the lowest possible price ( the worse move this year) and bought Swedbank stocks for this money (hopefully not the second worse move).

I am a longterm investor with more or less buy and keep strategy so I do hope that in a couple of years (2-3 years) this case will be a positive one.

Let the game begin for 2020!

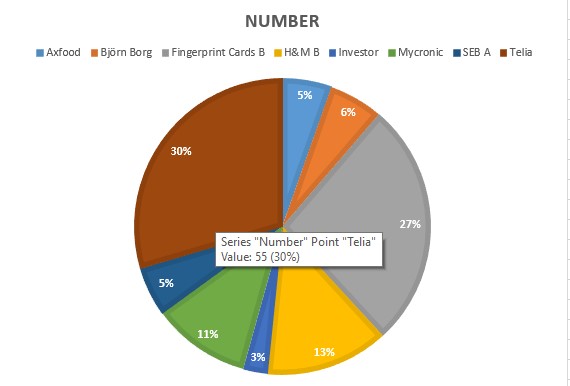

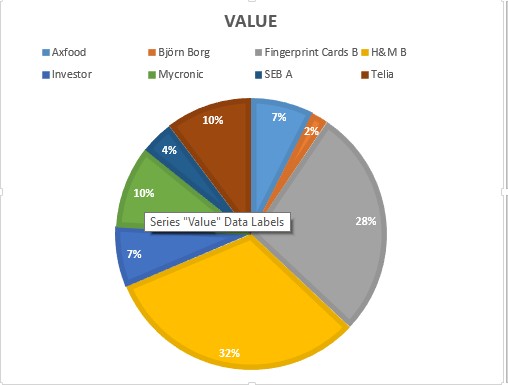

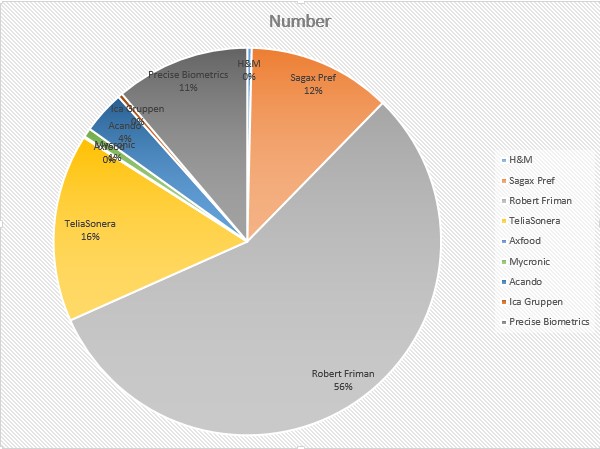

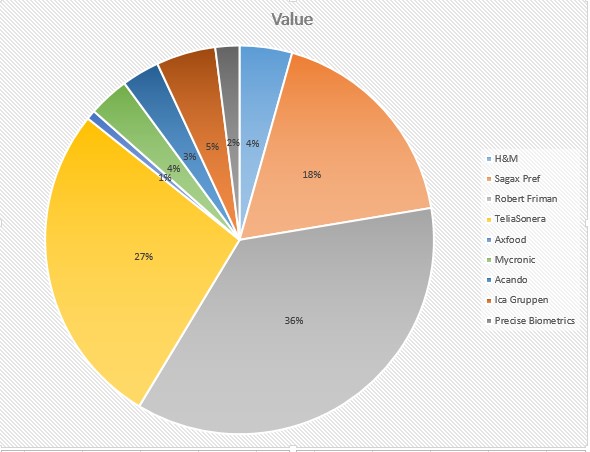

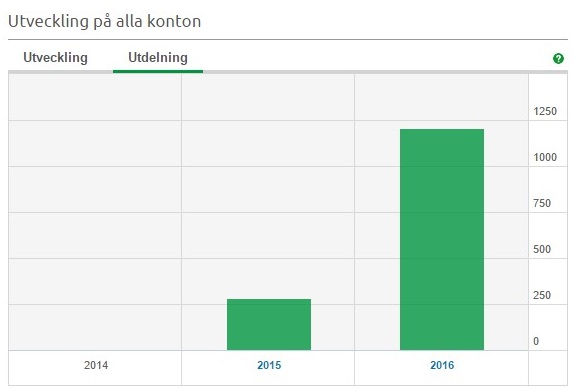

Picture: In 2013 I sold of all the stocks I had and started in 2015 again to invest in stocks.

In my portfolio, I had obtained 250 Units of Dividend Sweden, because I used the 750 subscription rights that the owners got. I also got 246 kr dividends from Axfood. These I reinvested in 12 Sagax D stocks increasing the dividend 24 kr per year.

In my portfolio, I had obtained 250 Units of Dividend Sweden, because I used the 750 subscription rights that the owners got. I also got 246 kr dividends from Axfood. These I reinvested in 12 Sagax D stocks increasing the dividend 24 kr per year.