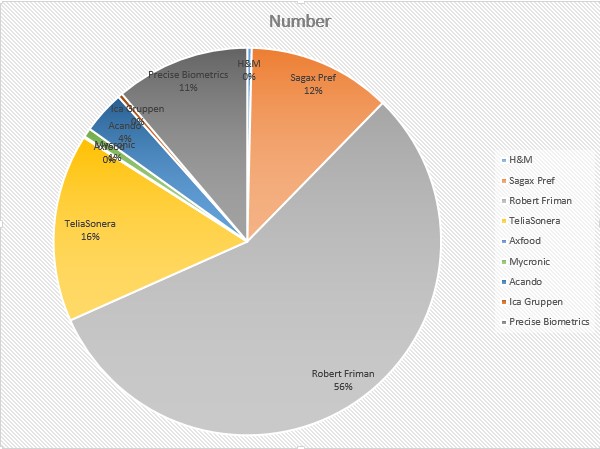

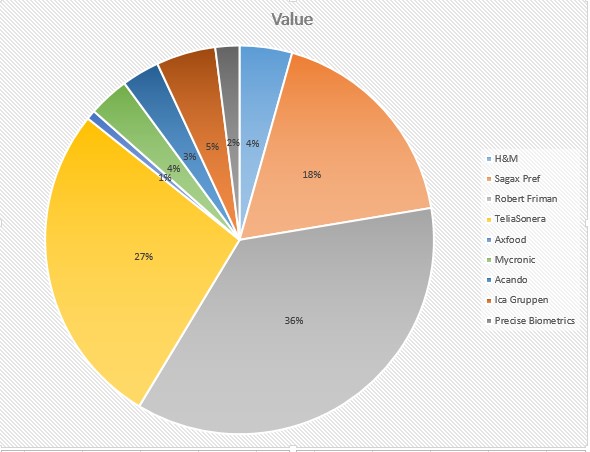

A&A´s portfolio: First dividends in year 2017 have started rolling in. In January they got 36 kr in dividends. I also bought them 3 H&M and 30 Sagax Pref stocks. This should generate 89,25 kr dividends extra per year. For the first time I also bought the Avanza zero fund for 100 kr (~10 Euro). I have decided that I will invest 100 kr monthly in this.

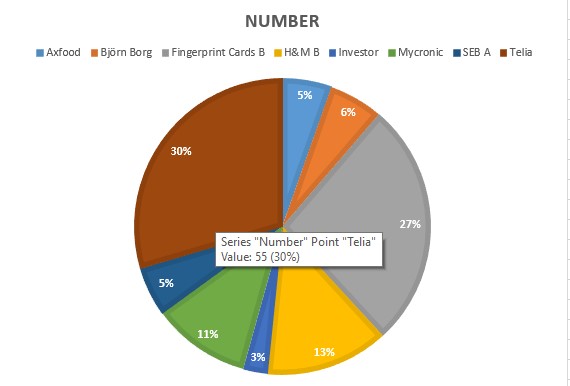

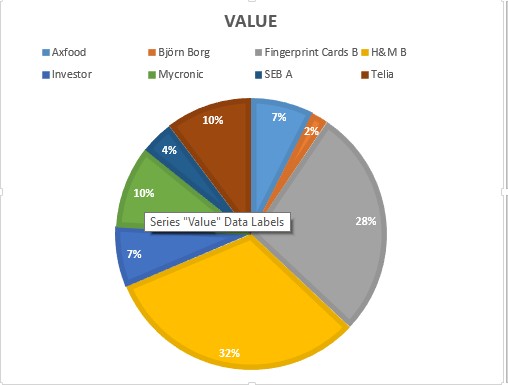

My portfolio: Here I got 236 kr in dividends from Sagax Pref, Saga D and Bald Pref. Additionally I bought 5 Axfood, 30x Sagax Pref and by chance 750 Dividend Sweden stocks. Axfood and Sagax Pref should generate 75 kr dividends per year. The 750 stocks of Dividend Sweden I bought by chance might generate 37,5 kr per year. This is however a high risk game, but I found the company interesting so I wanted to have a small part of it. I also started saving in the Avanza Zero fund.

Lately, I am considering to start buying some index funds and fill the portfolio with a part of funds. I would like to have some index funds especially some global index fund but I haven´t had time to check it up further.

A&A portfolio: Prve dividende u 2017. su stigle na račun. U januaru su dobili 36kr u dividendama. Ovog mjeseca sam im kupila 3 H&M I 30 Sagax Pref dionica. To bi trebalo dodati 89.25 kr dividendi godišnje. Prvi put sam isto kupila Avanza Zero fond za 100 kr (~10 Eura). Odlučila sam 100 kr mjesečno odvojiti za ovaj fond.

Moj portfolio: I kod mene je prva dividenda ušla na račun. Dobila sam 236 kr od Sagax Pref, Saga D i Bald Pref. Kupila sam dodatno 5 Axfood, 30 Sagax Pref i slučajno mi prođe kupovina 750 komada od Dividend Sweden. Axfood i Sagax Pref, bi trebali dodati 75 kr dividende godišnje. A ovih 750 komada Dividend Sweden su čista kocka, ali mi firma djeluje interesantna pa sam htjela da imam udio u tome.

Počela sam na mjesečnoj bazi da za 100 kr (~10 Euro ) kupujem Avanza Zero fond.

U zadnje vrijeme nešto razmišljam da raširim naše portfolie i da počnem kupovati fondove. Tu kontam neke indeksfondove pogotovo globalne, ali nisam stigla to još provjeriti koje su i gdje ih mogu kupiti,