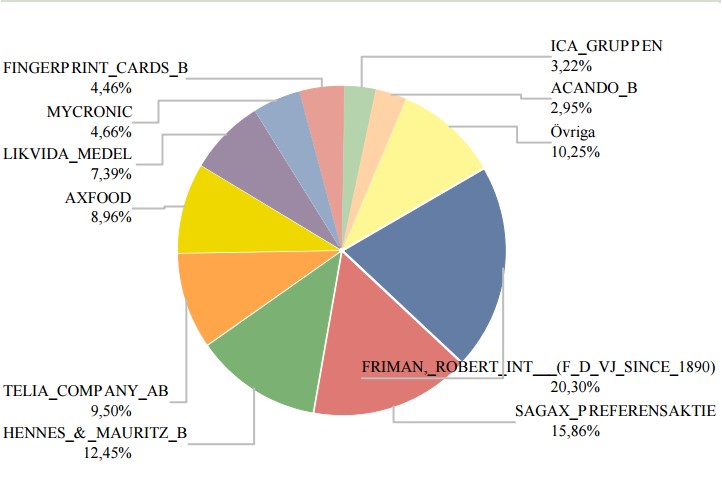

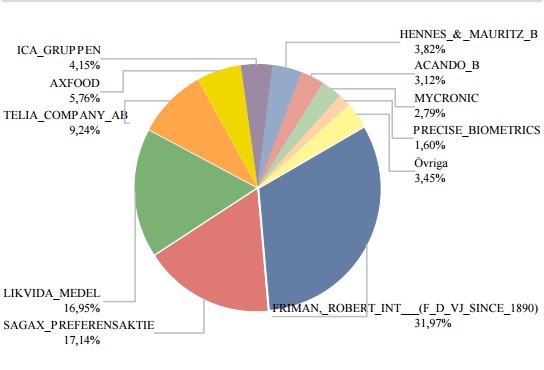

Last couple of months I have started saving in different funds. The problem I experience is that I cannot buy foreign stocks on my Swedish accounts because I do not live in Sweden and thus funds have became the only way I can diversify my portfolio towards a more global spread. But also, I do not have the time to check separate stocks and I feel that a fund is a good way to get stocks that I like.

I decided on funds that are not having a very high management fees (except the Ny teknik -fund that has it). Having these funds I actually get access to companies like Alibaba, Samsung , Alphabet (Google), FB, Investor and so on.

So the funds I am regularly buying are (management fees in %):

- SEB Sverigefond (1.4%),

- Spiltan Aktiefond Investmentbo (0.27%),

- Swedbank Robur Access Asien (0,2%),

- Swedbank Robur Access Global (0,27%),

- Swedbank Robur Ny teknik (1,36%) and

- Spiltan räntefond Sverige (0,24%).

The Räntefond is a bond fund that I hope will be a little like an airbag in case of a stockmarket crash.

Funny now, when making this list I noticed that I am buying the wrong fond SEB Sverigefond instead of SEB Sverige Indexfond that costs 0.42% in management fee instead of 1.4%, but also I should probably start relocating some of the savings to the more stable bond funds.

The minimal sum of investing is 10 Euro and there is no brokerage fee when buying funds (in Sweden).

These are also not a recommendation but everyone has to make their own choice of which stocks or funds to buy.

Here is a fun page where you can enter how much money you save and the effect of the compound effect has on your saving.

Posljednih par mjeseci sam počela štediti u različite fondove. Problem koji doživljavam jeste da ne mogu kupovati inostrane dionice na mojim švedskim računima, jer ne živim u Švedskoj i stoga su fondovi postali jedini način na koji mogu diverzifikovati moj portfolio da bude više globalnog izgleda. Odlučila sam kupovati fondove koje nisu skupe u menedžmentu fonda (osim Ny teknik fond). Imajući ove fondove, imam udio u firme poput Alibaba, Samsung, Alphabet (Google), FB, Invesor i tako dalje. Dakle, sredstva koja redovno kupujem su (naknade za upravljanje u %):

- SEB Sverigefond (1.4%),

- Spiltan Aktiefond Investmentbo (0.27%),

- Swedbank Robur Access Asien (0,2%),

- Swedbank Robur Access Global (0,27%),

- Swedbank Robur Ny teknik (1,36%) and

- Spiltan räntefond Sverige (0,24%).

Räntefond je kamatni fond koji (se nadam) treba biti poput airbaga u slučaju pada na berzi.

Smiješno, sad vidim kad sam pisala listu da kupujem pogrešan fond! SEB Sverigefond, koji košta 1.4%, umjesto SEB Sverige indexfond koji košta 0,42% godišnje. Najvjerovatnije bih trebala početi prebacivati neke štednje u stabilnije kamatne fondove.

Najmanji ulog za kupovinu fondovoa je 100 kr (ca. 10 eura) i nema courtage koštanje, zato je dobro redovno štediti u fondovima.

Ovo nisu prijedlozi nekome za kupovinu, nego samo fondovi koje ja sama kupujem. Svako mora za sebe odlučiti šta će i ako će kupiti.

Ovdje možete da izračunate koji udar ima kamata na vašu dugoročnu štednju.

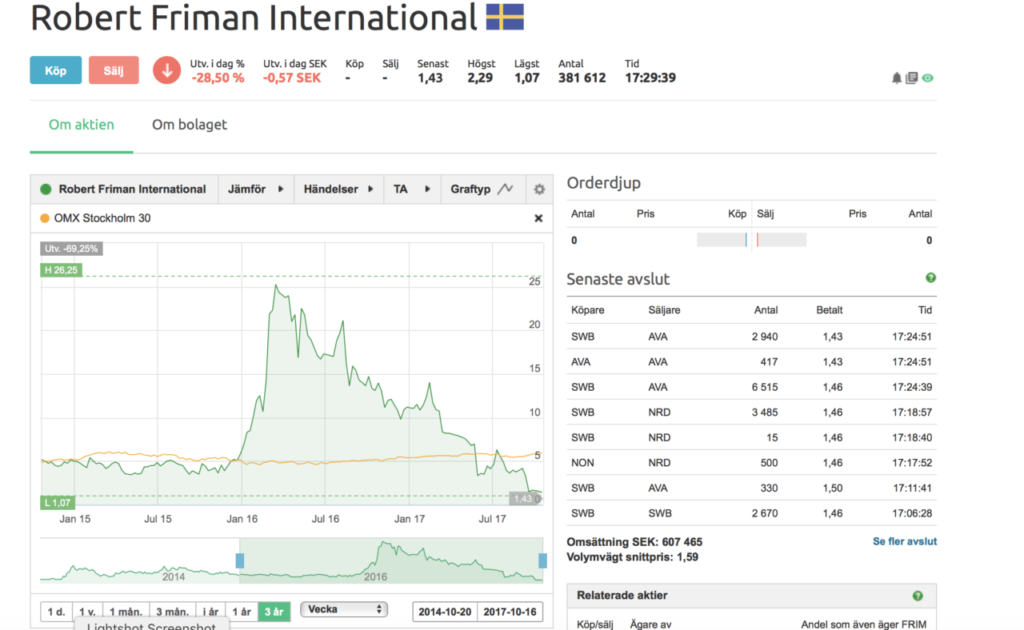

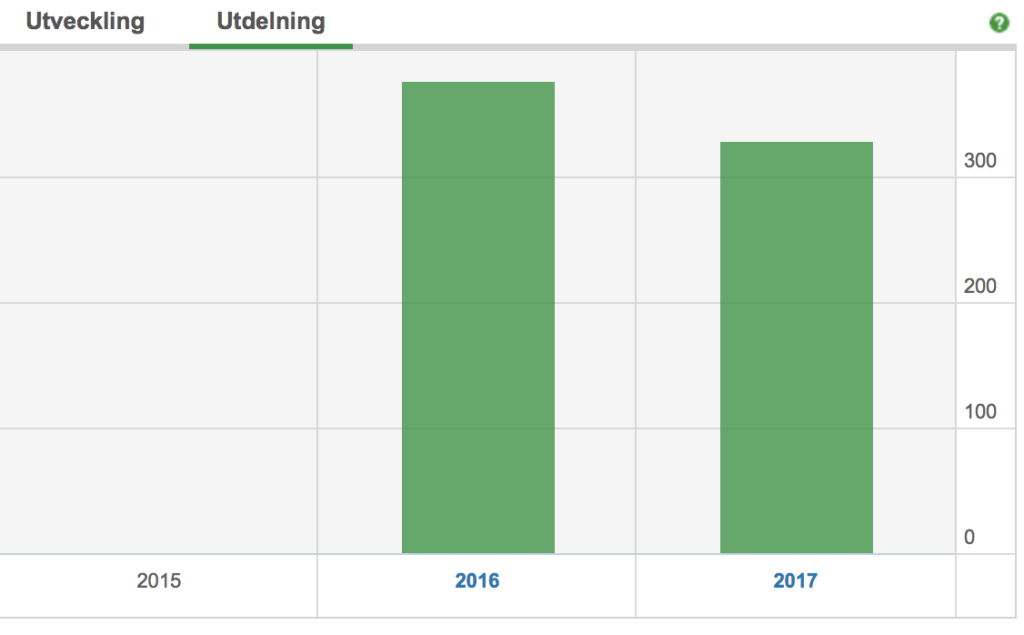

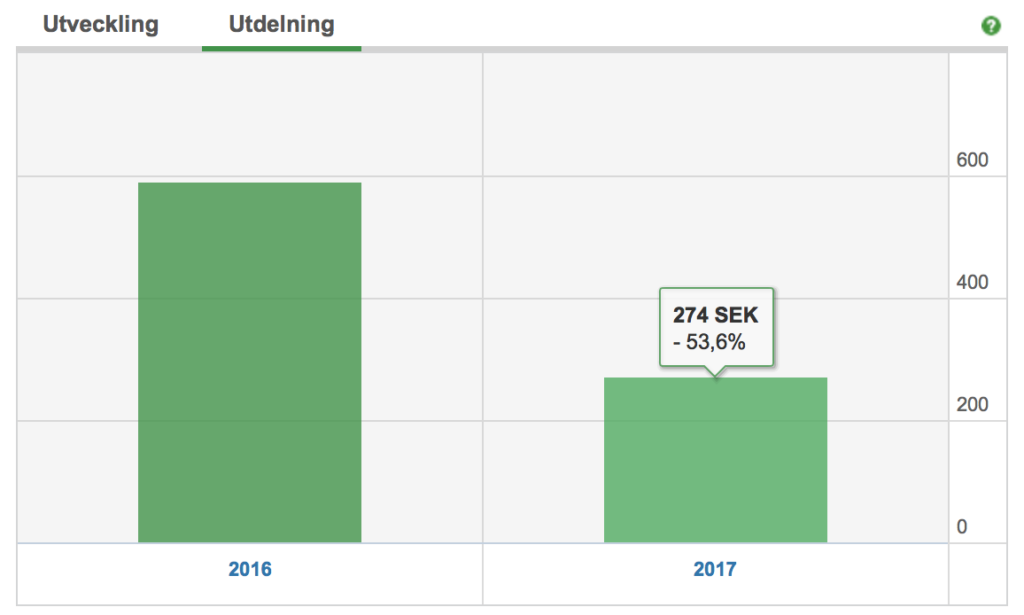

Ovo je bila dionica na koju sam najviše mogla zaraditi od svih mojih dionica i gdje je toliko očigledno kako ljudski mozak funkcioniše. Jedno vrijeme sam bila čitavih 180% u plusu. Naravno pohlepa je tu bila i htjela sam još. Kad je kurs počeo padati čekala sam i mislila sam proće nakon nekog vremena. (Planirala sam ih 5 godina držati).

Ovo je bila dionica na koju sam najviše mogla zaraditi od svih mojih dionica i gdje je toliko očigledno kako ljudski mozak funkcioniše. Jedno vrijeme sam bila čitavih 180% u plusu. Naravno pohlepa je tu bila i htjela sam još. Kad je kurs počeo padati čekala sam i mislila sam proće nakon nekog vremena. (Planirala sam ih 5 godina držati).

Ovaj mjesec je bio tako deprimirajući meni. Ne samo što sam ja bila bolesna čitav mjesec nego je i Ada više vremena provodila kod kuće nego u vrtiću. Samim tim niti sam imala vremena da čitam, niti da pišem, niti da se angažujem oko ićega pa čak ni u dionice.

Ovaj mjesec je bio tako deprimirajući meni. Ne samo što sam ja bila bolesna čitav mjesec nego je i Ada više vremena provodila kod kuće nego u vrtiću. Samim tim niti sam imala vremena da čitam, niti da pišem, niti da se angažujem oko ićega pa čak ni u dionice.

Prvi mjesec sa dvoje djece je prošao i razmišljala sam malo o njihovoj budućnost I štednji. Odlučila sam da ipak samo jedan račun imam za njih dvoje. Osjeća se malo poštenije u slučaju da jednom padne vrijednost dionica a drugom se dignu. Ovako djele na dva.

Prvi mjesec sa dvoje djece je prošao i razmišljala sam malo o njihovoj budućnost I štednji. Odlučila sam da ipak samo jedan račun imam za njih dvoje. Osjeća se malo poštenije u slučaju da jednom padne vrijednost dionica a drugom se dignu. Ovako djele na dva.

“Neodoljivi moć novca, poluga koja može podići svijet. Jedine stvari koje to mogu su ljubav i novac.’

“Neodoljivi moć novca, poluga koja može podići svijet. Jedine stvari koje to mogu su ljubav i novac.’