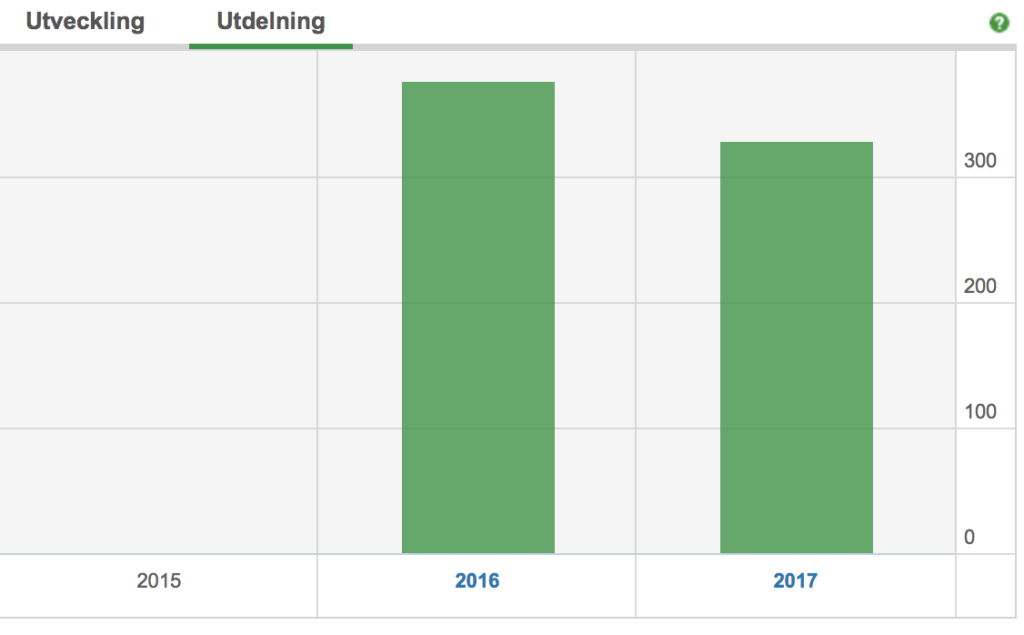

The A&A portfolio gained 173,5 kr in dividends. The companies paying out dividends where Fast. Balder Pref, Telia, Cloetta, Sagax pref, Sagax D and SEB B. This month I reinvested the dividends plus added a little of the child benefit to buy 2 Castellum, 6 Telia, 1 Fast Balder Pref and the index fund Avanza Zero (100kr). This should add 21 kr to the end of 2017, and for 2018 it should add 42 kr to the dividends per year.

From January AA portfolio has gained 330kr dividends..

A&A portfolio je ovog mjeseca dobio 173,5 kruna dividendi. Produzeća koja su dijelila dividende ovog mjeseca su Fast. Balder Pref, Telia, Cloetta, Sagax pref, Sagax D i SEB B. Reinvestirala sam dividende u 2 Castellum, 6 Telia, 1 Fast Balder Pref i indeks fond Avanza Zero (100kr). To bi trebalo dodati još 21 kr u 2017 a 42 kr u 2018.

Slika: Od januara do sad je AA portfolio dobio ukupno 330 kr dividendi.

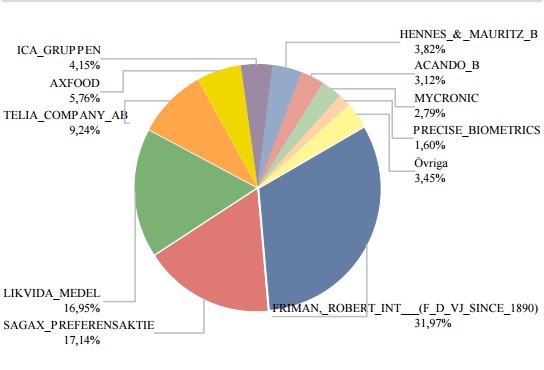

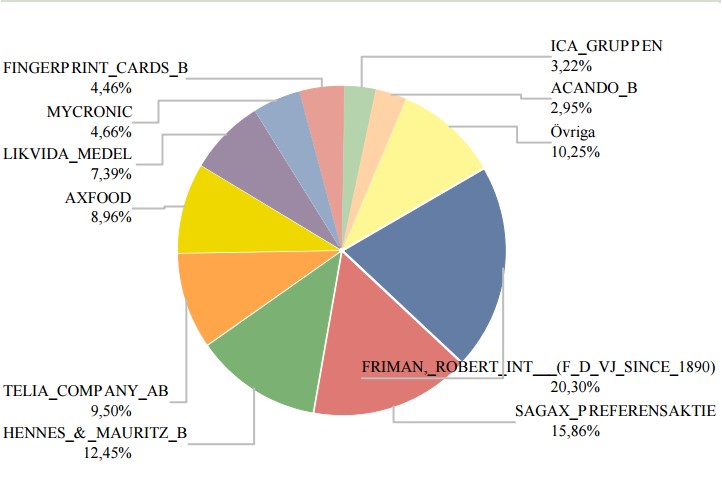

My portfolio:

This month Ica Gruppen, Sagax D, Sagax Pref, Telia, Cloetta and Fast Balder Pref were paying out dividends. I got 744 kr this month. I bought 7 Telia and 2 Castellum for the money. I also bought Avanza Zero and Swedbank Robur Ny teknik fund for 100 kr each. This should add 12 kr dividends per year and another 24kr dividends in 2018.

Picture: Here another 317,5 kr should be added to, but the dividends are gained in other accounts in total 1228,5 kr in total this year.

Slika: U 2017 treba dodati još 317,5 kr dividende koje su dobivene na drugim računima ukupno sam od januara dobila 1228,5 kr dividendi.

Moj portfolio:

Ovog mjeseca su Ica Gruppen, Sagax D, Sagax Pref, Telia, Cloetta i Fast Balder Pref isplatili dividende. Dobila sam 744 kr ovog mjeseca. Kupila sam 7 Telia i 2 Castellum za dividendu. Kupila sam isto Avanza Zero i Swedbank Robur Ny teknik fondove. To bi trebalo dodati 12 kr dividende za 2017 a za 2018. godinu bih trebala dobiti dodatnih 24 kr.

Prvi mjesec sa dvoje djece je prošao i razmišljala sam malo o njihovoj budućnost I štednji. Odlučila sam da ipak samo jedan račun imam za njih dvoje. Osjeća se malo poštenije u slučaju da jednom padne vrijednost dionica a drugom se dignu. Ovako djele na dva.

Prvi mjesec sa dvoje djece je prošao i razmišljala sam malo o njihovoj budućnost I štednji. Odlučila sam da ipak samo jedan račun imam za njih dvoje. Osjeća se malo poštenije u slučaju da jednom padne vrijednost dionica a drugom se dignu. Ovako djele na dva.